As enterprises shift toward subscription, usage-based, and hybrid revenue models, legacy billing architectures are increasingly becoming a constraint rather than an enabler. Buyers today must evaluate not just how invoices are generated, but how revenue flows across sales, finance, and operations from quote to recognition.

This article compares Revenue Cloud Management with Traditional Billing Systems, focusing on architecture, buyer impact, and cost implications.

Understanding Revenue Cloud Management

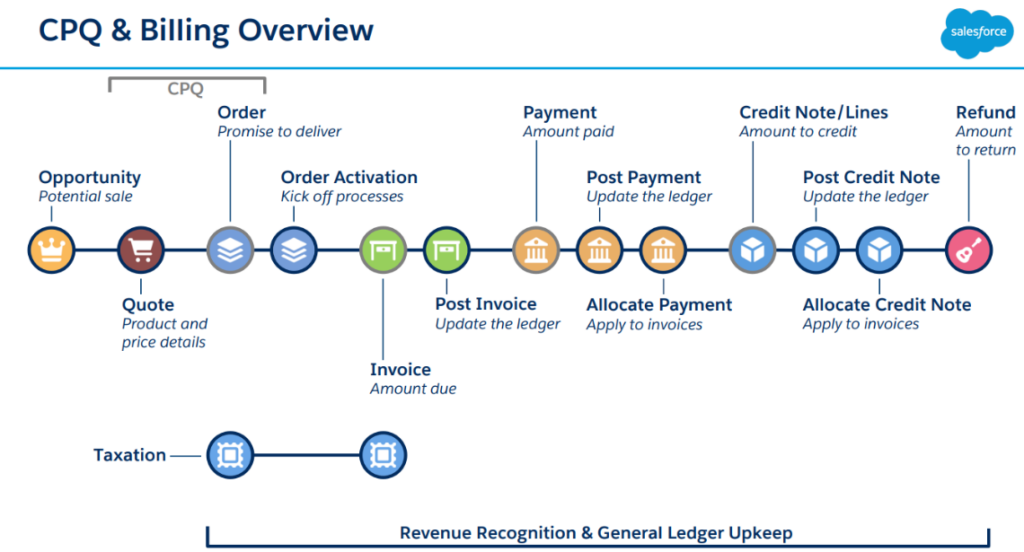

Revenue Cloud Management is purpose-built for businesses operating subscription, consumption-based, or evolving pricing models. It represents a unified approach to the entire Quote-to-Cash lifecycle.

Instead of treating pricing, billing, and revenue recognition as disconnected activities, Revenue Cloud Management orchestrates them as a single, automated flow. Automation spans from pricing configuration through invoicing and revenue recognition, reducing manual intervention and operational friction.

The core objective of Revenue Cloud Management is end-to-end revenue orchestration across sales, finance, and operations. This alignment allows organizations to introduce new revenue models faster while maintaining financial accuracy and compliance.

Buyer Impact of Revenue Cloud Management

For buyers, the most visible benefit is speed. Enterprises gain faster time-to-market for new offerings and can adapt pricing and packaging without large engineering dependencies.

Operationally, teams experience fewer handoffs between systems, a reduction in errors caused by manual processes, and significantly improved visibility into revenue performance across the lifecycle.

Understanding Traditional Billing Systems

Traditional Billing Systems were designed for static, one-time transactions. They are often on-premises, fragmented, and optimized for post-sale billing execution rather than revenue orchestration.

These systems typically focus on accurate invoice generation and payment processing. Pricing, contracts, and entitlements are managed in upstream systems, creating dependencies and silos.

When business models evolve, traditional billing platforms rely heavily on manual reconciliations, spreadsheets, and custom engineering work to handle changes. While they perform well in stable, predictable billing environments, they struggle to support modern revenue complexity.

Buyer Impact of Traditional Billing Systems

From a buyer perspective, traditional billing systems introduce slower responses to market changes, higher operational overhead, and increased reconciliation effort. Manual processes elevate the risk of revenue leakage and reduce overall visibility into revenue health.

Feature Comparison: Revenue Cloud vs Traditional Billing

| Area | Revenue Cloud Management | Traditional Billing Systems |

| Revenue Model Support | Subscription and usage-based models | Primarily one-time, static transactions |

| Architecture | Unified, cloud-based Quote-to-Cash | Fragmented, often on-premises |

| Automation Scope | Pricing to revenue recognition | Billing and invoicing only |

| Change Management | Configuration-driven, low code | Manual updates and engineering effort |

| Revenue Visibility | End-to-end lifecycle visibility | Limited to post-sale billing |

| Operational Dependency | Cross-functional alignment | Heavy reliance on upstream systems |

Cost Considerations for Buyers

Revenue Cloud Management

Revenue Cloud Management typically involves a higher upfront investment due to licensing and implementation. However, enterprises benefit from lower long-term operational and maintenance costs.

Automation reduces manual effort, minimizes errors, and accelerates revenue realization. Over time, organizations see faster ROI driven by revenue optimization and operational efficiency.

Traditional Billing Systems

Traditional Billing Systems often appear cost-effective initially due to lower licensing costs. However, long-term expenses increase as organizations invest in customizations, manual processes, and reconciliation efforts.

Hidden costs frequently emerge in the form of revenue leakage, inefficiencies, and delayed market responsiveness.

Strategic Takeaway for Enterprise Buyers

The choice between Revenue Cloud Management and Traditional Billing Systems is less about billing functionality and more about revenue strategy readiness.

Enterprises planning to scale, experiment with pricing, or introduce subscription and usage-based offerings require a system that treats revenue as a connected lifecycle rather than a post-sale activity.

Revenue Cloud Management enables this shift by aligning technology with modern revenue operations.

If your organization is evaluating how to modernize its Quote-to-Cash processes or transition from legacy billing to a unified revenue platform, now is the right time to assess architectural fit, long-term cost impact, and operational scalability.

Talk to our experts to understand how Revenue Cloud Management can support your revenue transformation goals. Contact us.